Complexity and Obligation: With an SDIRA, you have got more Handle over your investments, but You furthermore mght bear additional duty.

Put simply just, when you’re searching for a tax economical way to create a portfolio that’s extra tailor-made towards your pursuits and abilities, an SDIRA could possibly be the answer.

Transferring resources from 1 variety of account to another form of account, for instance going resources from the 401(k) to a conventional IRA.

Increased Expenses: SDIRAs generally include better administrative charges in comparison to other IRAs, as particular aspects of the executive course of action can't be automatic.

IRAs held at banks and brokerage firms offer limited investment options for their consumers as they don't have the expertise or infrastructure to administer alternative assets.

The primary SDIRA regulations in the IRS that traders need to grasp are investment restrictions, disqualified individuals, and prohibited transactions. Account holders ought to abide by SDIRA rules and rules so that you can preserve the tax-advantaged status of their account.

Number of Investment Options: Ensure the supplier lets the kinds of alternative investments you’re thinking about, for example real estate property, precious metals, or non-public fairness.

Earning quite possibly the most of tax-advantaged accounts helps you to retain far more of the money you commit and make. Based on whether you decide on a traditional self-directed IRA or maybe a self-directed Roth IRA, you might have the prospective for tax-totally free or tax-deferred advancement, offered certain problems are achieved.

Constrained Liquidity: Lots of the alternative assets that could be held in an SDIRA, for example real estate property, private equity, or precious metals, is probably not very easily liquidated. This may be a difficulty if you need to accessibility funds speedily.

The tax pros are what make SDIRAs attractive For a lot of. An SDIRA might be equally common or Roth - the account variety you choose will depend mostly on your own investment and tax approach. Examine together with your financial advisor or tax advisor when you’re Doubtful and that is most effective for you.

In some cases, the service fees associated with SDIRAs may be greater and even more difficult than with a regular IRA. This is because of the increased complexity associated with administering the account.

Once you’ve found an SDIRA company and opened your account, you may be pondering how to really begin investing. Knowledge both the rules that govern SDIRAs, and also ways to fund your account, might help to lay the foundation for the future of prosperous investing.

Be in charge of the way you grow your retirement portfolio by utilizing your specialised awareness and pursuits to take a position in assets that healthy with the values. Acquired experience in real estate or private equity? Use it to help your retirement planning.

Homework: It is really identified as "self-directed" for a motive. With the SDIRA, you will be completely chargeable for extensively looking into and vetting investments.

Believe your Mate is likely to be beginning the next Fb or Uber? With the SDIRA, you could spend money on leads to that you suspect in; and most likely enjoy bigger returns.

Opening an SDIRA can present you with access to investments Commonly unavailable by way of a bank or brokerage firm. Here’s how to start:

Consumer Support: Hunt for a supplier which offers devoted aid, which includes usage of well-informed specialists who will reply questions on compliance and IRS guidelines.

An SDIRA custodian is different because they have the suitable staff, skills, and capacity to keep up try these out custody of your alternative investments. The first step in opening a self-directed IRA is to locate a service provider which is specialised in administering accounts for alternative investments.

Yes, real estate property is among our customers’ most favored investments, sometimes referred to as a real estate property IRA. Clients have the choice to speculate in every little thing from rental Houses, professional real estate, undeveloped land, mortgage loan notes and even more.

Jonathan Taylor Thomas Then & Now!

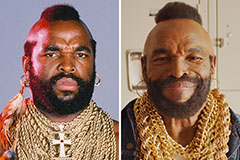

Jonathan Taylor Thomas Then & Now! Mr. T Then & Now!

Mr. T Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Joshua Jackson Then & Now!

Joshua Jackson Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now!